Overview

In the end, having a business makes you think of a way to earn direct money. Delivering an application allows you to have a great profit. A major part of that profit comes from payment gateway apps.

The use of mobile apps has also increased. End users now use apps for every little thing. Pandemic has fueled the rise of mobile apps. COVID-19 has transformed the app’s adoption trends and made them a daily activity rather than a luxury.

It is important to provide your users with a space where they can pay in the app itself. Like for in-app purchases or to have more app features, a payment gateway can help the users to make a payment directly through the app.

If you want to earn profit in this heavy use, a payment gateway is a great method. This guide will give you valuable insights on how to integrate payment gateway in mobile applications.

Statistics

Before going further into Payment Gateway, it will be better to let you know about the current market analytics of the payment gateway.

- The global market size of payment gateway was around 18.2 billion in 2020, its compound annual growth rate is expected to be 21.7% from 2021 to 2028.

- According to research by Finaria.it. The global digital payment industry has grown by 6.6$ trillion in 2021.

What is Payment Gateway?

A payment gateway is an application that builds a digital space for its users to have a secured transaction. The users are buyers and sellers, who agree to make an online transaction. It acts as a mediator between the customer and the payment processor.

A payment gateway is an application that builds a digital space for its users to have a secured transaction. The users are buyers and sellers, who agree to make an online transaction. It acts as a mediator between the customer and the payment processor.

Working with encryption that secures sensitive data, Payment gateways are now widely used for e-commerce. The payment processor here is the final decision-makers to finish a completely online payment. It helps to authenticate the customer and analyze given information.

Between buyer and seller, banks also play a vital role. The bank that serves the consumer makes sure the time and security of the transaction. In case of returns or refunds, the bank takes charge and completes the process.

Here are 4 types of widely used payment gateways to get your understanding clear.

Hosted Payment Gateways

Hosted Payment Gateways

These types of payment gateways direct the consumer away from the site’s checkout page. The consumer then clicks the gateway link, which redirects them to the payment service provider.

At PSP, the consumer can fill in payment details. After they have completed the payment process, they are redirected towards a website where they can checkout.

Self-hosted Payment Gateways

Consumer details are requested, and when the details are collected it is sent to the payment gateway’s URL. The data is collected within the merchant’s website.

With this type of gateway, some apps require the payment data to be provided in a specific format. Others demand a hash key or secret key.

API hosted payment gateways

Payments in this type of gateways are processed through API (Application Programming Interface) or HTTPS queries. With API-hosted payment gateways, buyers enter the credit or debit card information directly on the merchant’s checkout page.

These types of payment gateways are completely customizable and offer full control over UX and UI.

Local Bank Integration

Buyers here have to make payment on the payment gateway’s page or the bank’s website. Local bank integration payment gateway redirects the customer to the bank’s page, where they provide their payment and contact details.

It is a quick and easy step process. The consumer then is redirected back towards the merchant’s website.

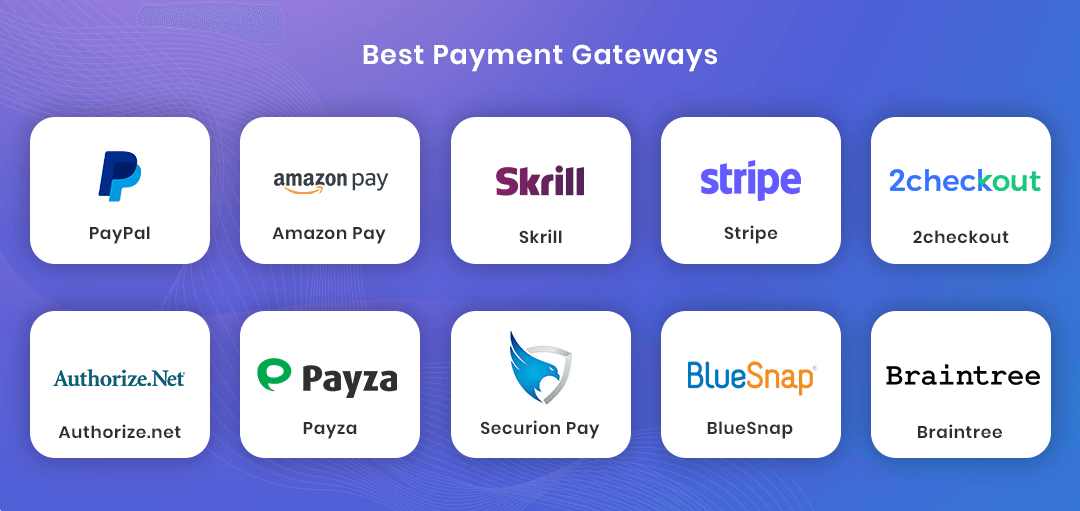

Best Payment Gateways available Contemporarily

Want to know the successful platforms that made payment gateways a popular trend? Here’s the list of the top 10 market giants that provide platforms for payment gateway.

This e-commerce platform is specially designed to facilitate people and companies to have secure online transactions.

This payment gateway is specifically designed for merchants and shoppers on Amazon. It provides simple, fast, and secured payment solutions.

By understanding modern payment demands, Skrill has made itself the top company providing the most innovative business solutions.

A cloud payment gateway platform that provides a complete set of solutions. It helps to accept and manage online transactions anywhere in the world.

This payment gateway platform allows businesses to accept online payments irrespective of the buyer’s currency. It has several localized payment options that make payment easy.

A global payment gateway that facilitates its users with strong app architecture. With complete security, it ensures smooth and fast transfer of transactional data.

Payza

One of the most convenient payment gateway solutions for businesses and people. It provides multiple account types for different customers.

Securion Pay

This gateway platform supports a wide range of operating systems. Including Windows, Mac, Linux, Android, and iOS.

BlueSnap

BlueSnap enables businesses to scale globally and make transactions from local to international customers.

Braintree (A PayPal Company)

Being a part of the PayPal network, this is designed to make the payment process easier. Offering several commerce tools that build a global business.

Benefits of Payment Gateways

There are many advantages of integrating Payment Gateway in Android and Payment Gateway in iOS. We have compiled some of them here for you.

Simple Checkout

Simple Checkout

A seamless checkout process is important from the customer’s side, Payment Gateways provides functions that make online shopping amazingly streamlined

Easier Purchase

Many consumers make impulse purchases that are enabled through a payment gateway. The buyer usually drops any shopping if the transaction is complicated.

Security of transaction

Adept security standards work in compliance with payment Gateways making a transaction reliable.

Integrates with Shopping cart

Easy integration and also provides faster payment with multiple payment options.

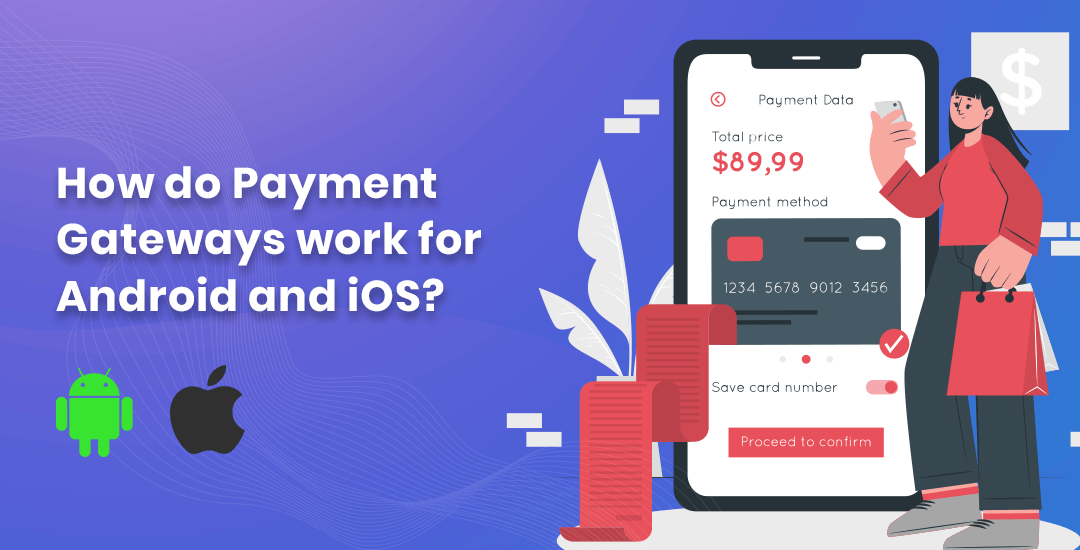

How do Payment Gateways work for Android and iOS?

Online payment includes two important factors. One is Payment Gateways and another is the payment processor. Complete payment is processed when these two factors are blended.

Online payment includes two important factors. One is Payment Gateways and another is the payment processor. Complete payment is processed when these two factors are blended.

In this payment process, the payment gateway’s role is to initiate and gauge the transaction. It will receive the transaction details from the consumer through the checkout page. Then, its responsibility is to authenticate the given information.

After that payment processor starts its work to complete the transaction.

How to integrate Payment Gateway into an Android App?

Stripe is one of the most convenient options for developing payment gateways into mobile applications. Here we have listed a shorter form of the process for a simpler and better understanding of the payment gateway integration into the front-end side.

Follow the steps for a clear understanding.

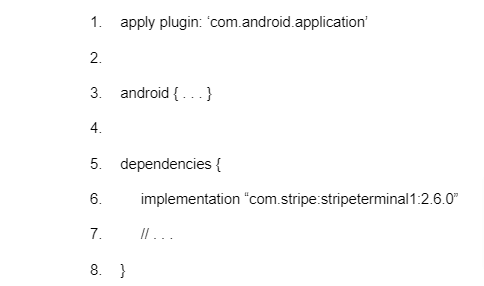

Install a Stripe SDK

Start with the step of adding stripe-android. For this, install the SDK and then add stripe-android to the dependencies block. The dependencies will be available on the app/build.gradle file.

Here is the code: –

App’s Configuration

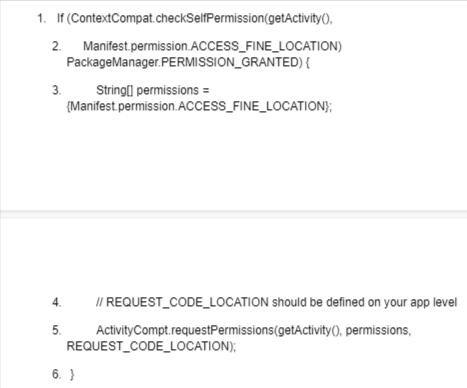

First, let’s start with enabling location access for the use of Android SDK. Start with the code mentioned below to have a finely defined location access enabled on the android device.

Here is the code: –

You also have to check that the user grants permission, without their permission, the SDK won’t work. For verification, you have to override the onRequestPermission method.

Here is the code : –

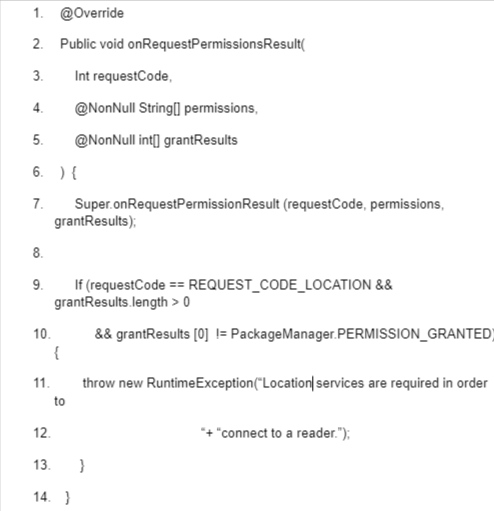

Code an ephemeral key

The ephemeral key is to be added in the back-end development, but you need to create a provider class for the ephemeral key. The provider class enables the client-side to communicate with the back-end ephemeral key

Here is the Code: –

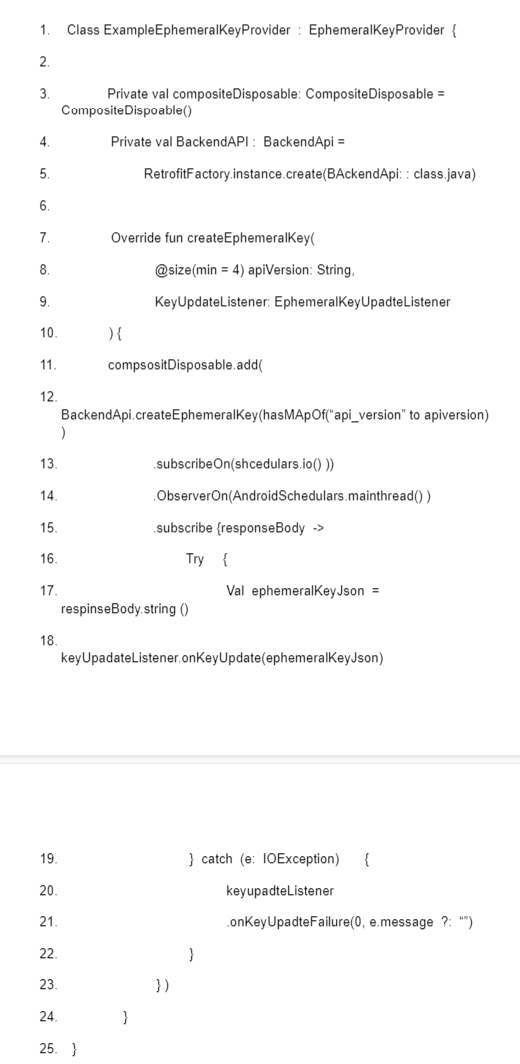

Setting up a connection Token Endpoint

In order to connect to a reader, the backend development requires giving the SDK permission of using the reader with the stripe account. Forgiving SDK this access in endpoint, the developer has to implement the ConnectionTokenProvider interface.

This function is used whenever the SDK is demanded to authenticate with readers in stripe. It also plays a role when a new connection token is needed to connect to a reader.

Here is the code: –

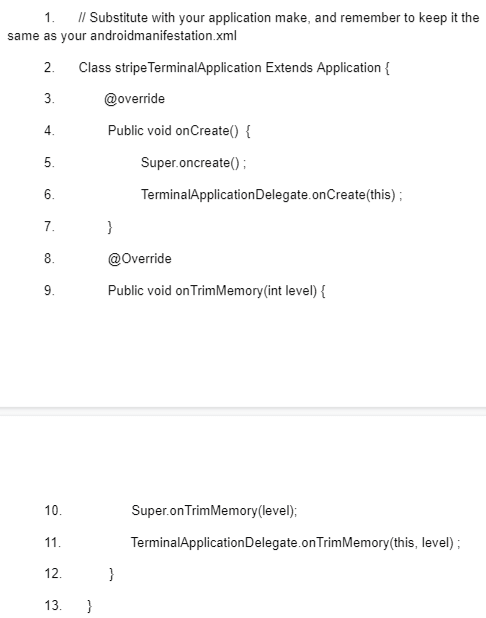

Initializing the SDK

The coding lifecycle for Android SDK needs a setup to prevent memory leaks and ensure proper clean-up after a long-running Terminal SDK process. The application should implement an Application Subclass using TerminalApplicationDelegate.

Here is the code:

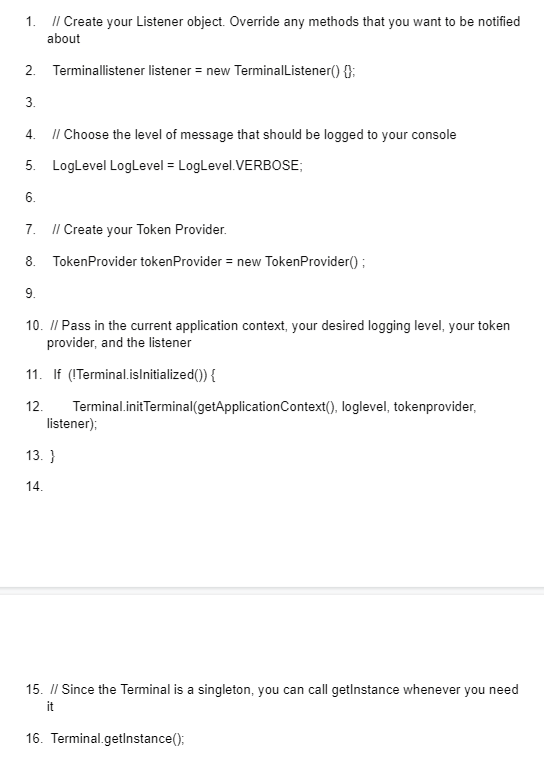

Adding TerminalListner Object

To support the initialization, you have to provide the current application context. Using the connectionTokenProvider and the Terminallistening object, you can use it to handle events from the SDK.

Here is the code: –

This is the basic development coding lifecycle of a payment method through Stripe. Adding features like consumer sessions, payment sessions, payment methods, and many more. All these features have different types of coding systems and depend on their functioning and the level of roles to play.

How to integrate Payment Gateway into an iOS App?

Adding Stripe gateway provides a developer-friendly environment making payment options for an iPhone app. Here we have outlined the basic lifecycle of integrating Payment Gateway into the iOS app, focusing on server-side development.

Install a Stripe SDK

For developing an app that works in a completely functioning manner, you have to ensure the latest updated version of the app. There are various tools one can use for installing SDK, here we have considered Swift Package Manager.

To get started, open Xcode and follow the procedure:-

File>Swift Packages>Add Package Dependency.

Enter https://github.com/stripe/stripe-ios and choose the latest version.

Dissecting the installation process in iOS into three stages: –

- Creating Profile

- Punning Command

- Updating SDK to the Latest Version

For Creating a Profile, code this line

Pod ‘Stripe’

For Running the Command, add this line

Pod install

For Updating the Command to the latest version, here’s the code

Pod update Stripe

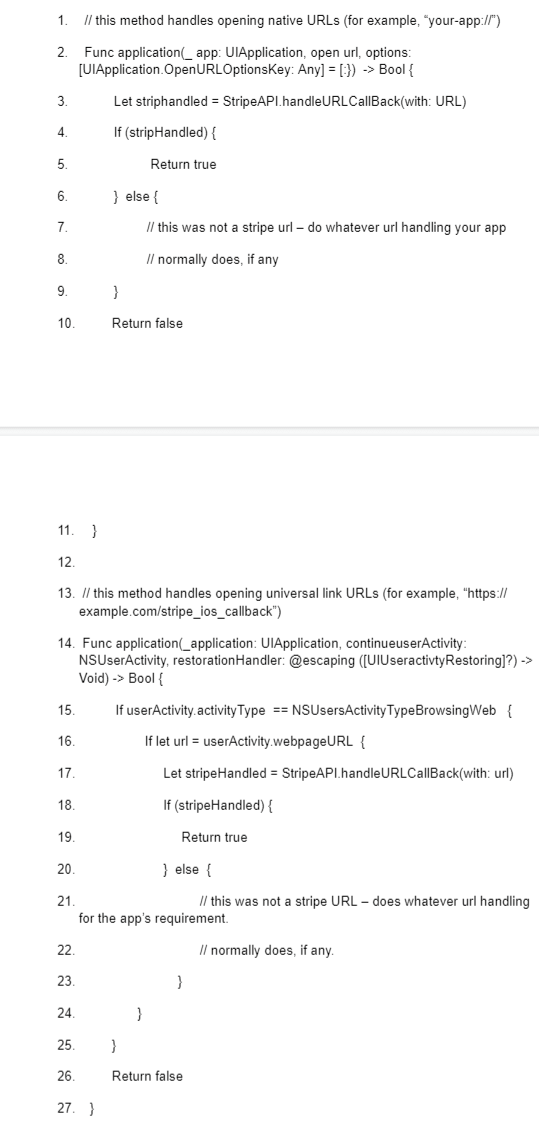

Redirect the user to authorize the source

The sources of SDK files require redirection for the consumer to authorize payment. Also, mention a URL for the consumer to return to the app. This stage includes Implementing custom URL schemes and supporting universal links.

Here’s an example of code for it: –

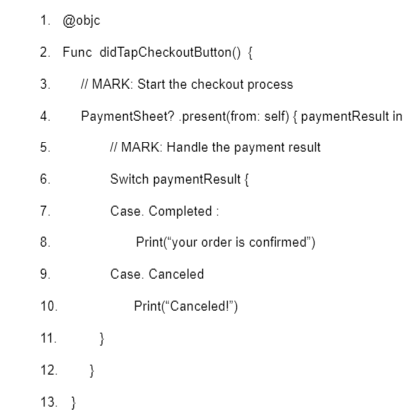

Selection and Collection for Payment

Developing a payment gateway includes checking the available payment methods and selecting options required for the app development.

After selection of the payment methods, one has to determine the details for collecting it. This includes adding several elements in the backend development. For the front-end, the developers have to connect the elements and set a publishable key with StripeAPI.shared.

After setting up the environment for payment collection, you have to code for collecting a payment sheet result.

Here’s the code for it: –

How to integrate Payment Gateway into a Hybrid App?

Choosing two different development platforms for two different Operating Systems costs more. There is an alternative to develop apps that work on both of the OS. This is a good choice to save money and time if you want to develop a payment gateway that works on any Operating System.

Install Ionic and Cordova plugins

Start with installing the native plugins to ensure the good functioning of the app and the payment gateway. For the installation process you use:

$ ionic Cordova plugin add com.paypal.cordova.mobilesdk

$ npm install –save @ionic-native/paypal

After installing, you can go ahead with the implementation

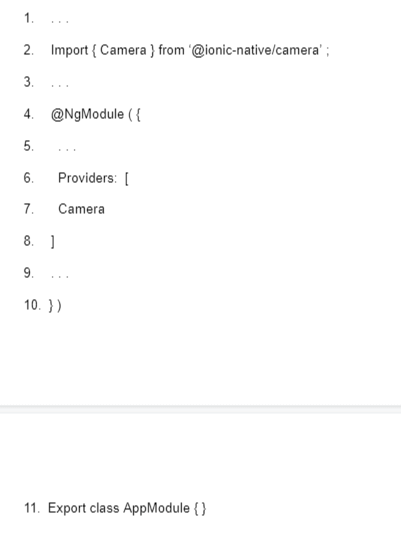

Implementing the Plugin

It is important to implement the plugin in your NgModule. This stage includes coding that helps in making the app more reliable for the Operating System.

Here’s an example of code for implementation

Adding Payment Gateway to the project

After the implementation, add payment gateway by using this line

$ npm I react-native-razorpay – – save

Installation

As you are done with adding the payment gateway, now your can move to setting up the command for automated installation process. Use this Command: –

$ react-native link react-native-razorpay

Basic Features that are must for Payment Gateway

Here is a complete checklist of basic elements your Payment Gateway should have

- Multi-Payment Method with diverse types of transactions

- Multi-channel Processing for different devices

- Diverse with linguistics

- Surpassing the currency boundaries, Multi-currency

- A system that looks after fraud and scam

- Responsive mobile Interface

- In-built analytics to look upon

- Direct Payment link to ease the transaction

Conclusion

Integrating Payment Gateway is very essential for an app. Be it a normal gaming app or an actual e-commerce app development. Including a feature where people can pay for various services is a good choice.

Nowadays, apps are used for every little thing and people see it worthy to pay for it. Not only for online shopping but for subscribing and in-app purchases having a well-implemented payment gateway is important.

This informational guide is for start-ups and enterprises that are looking to initiate their journey in converting their apps.

Auxano Global Services is a top bespoke app development company. We here have experts with complete dexterity in coding and development. Work with industry experts for your payment gateway. Our professionals understand the market and work accordingly. Having a successful history we look up to a great future.

If you wish to integrate a fully-functional payment gateway in android and iOS apps, contact us now.

Frequently Asked Questions

-

1. What is the possible scope of Payment Gateway in the coming years?

It is bound to rise, people have an ever-increasing demand for more functional and easy-to-do payments. It is a good time to enter the market.

-

2. By what factors can the cost of integrating Payment Gateways be decided?

The fundamental way to determine the cost of integrating payment gateways is the complexity of coding. Also, some platforms like PayPal charge per transaction.

-

3. Is it better to have an in-house team or go for outsourcing an agency?

Both are good, but having an in-house team sometimes demands more and serves less. In this case, an agency can help you with all the services and expertise.

-

4. What if the payment gateway faces any glitch?

There are chances, but if it happens then our team will solve it as soon as possible. In the meantime, we make sure that there aren’t any big losses.

-

5. Which agency should we choose to outsource?

Auxano Global Services can be your best choice. Our experts are chosen with complete filters of professionalism. Leverage a good payment gateway for android and iOS apps with us.

![Complete Guide to Create Decentralized Apps (Dapps) [2023]](https://auxanoglobalservices.co.uk/new/wp-content/uploads/2023/03/Front-506x289.jpg)