The FinTech domain is booming and all businesses are looking forward to having a dedicated application for their customers. Be it making transactions, checking payment history, or performing other vital activities, an application makes it easier for customers to get it done faster.

As more businesses are coming online and planning to make their operations more customer-focused, they get overwhelmed when it comes to FinTech app development. If we talk about the market size of the FinTech domain, it’s all set to cross the benchmark of $305 billion by the end of 2025. Last year, in 2020, this market was of around 105.3 billion dollars only in funding. With such huge numbers, it’s easy to predict how many businesses are taking an interest to finance operations.

One common question that comes to every company is how much does it cost to build a FinTech application? To be honest, the answer depends on a variety of factors and complexity involved in the project. Mainly, there are two major drivers of the price for developing applications — time and developers.

When it comes to developers, you have to pick who you want to work on your project — 2 years experienced individual or a full-fledged team with 10 years of experience. The more experienced developers you pick for your project, the price will go up and vice versa. However, hiring inexperienced developers always brings you uncertainty about various things.

The second factor is time — time to ideate, design, prototype, develop and deploy the application. All these factors depend on various sub-factors like features’ complexity, server architecture, and location. To help you get started with FinTech application development, we have you covered with all types of apps and their estimated cost.

So whether you are a startup or a small-scale full-fledged finance or enterprise company, these estimates will give you a fair idea about where to begin. Before we directly jump into the pricing of app development, first understand the types of applications that fall under the FinTech category.

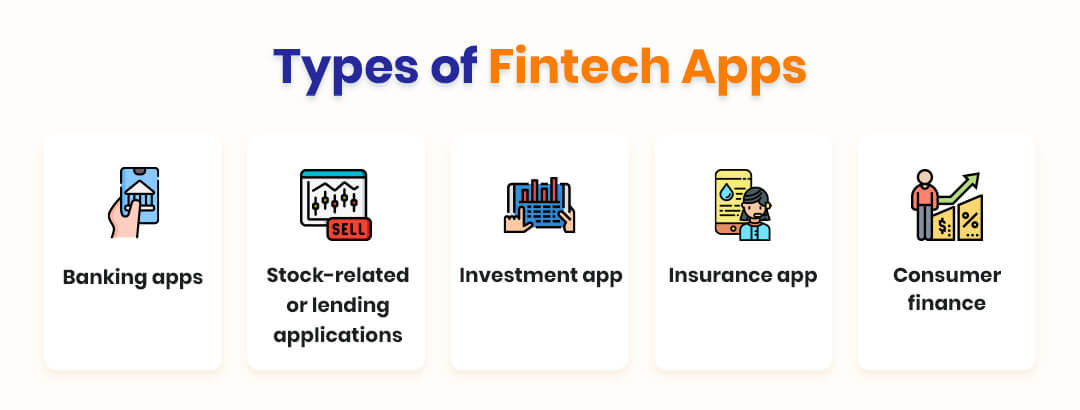

Types of Fintech Apps

With the ongoing digital disruption, there are several types of applications available in the market that might feel overwhelming to the new businesses. Be it banking apps, wallets, asset management apps, and more — all these applications have specific purposes for some business entities.

Banking apps

banking apps are the most commonly-developed applications that the majority of financial institutes use along with full-fledged banks. These applications support features like money transfers, credit support bill payments, and other fundamental features. We all use banking applications for personal banking that let us do the majority of the tasks without visiting a bank in person.

Stock-related or lending applications

With the ongoing trend of high-speed banking and services, apps for lending, borrowing, trading, and financial advisory sectors are booming. As the security and privacy concern grows among customers, these apps are based on peer-to-peer communication and are highly secure and encrypted. Peer-to-peer lending apps join people who are prepared to loan their money to other people who are in need of money. Such FinTech apps let users acquire a little cash against their next payment.

Investment app

The Post-pandemic era has fueled the investment sector and more people are actively taking interest in growing their portfolio. To make the investment easier, fast, and reliable, many companies now have their own investment application. These applications let users search for the best investment opportunities, compare returns, risk profiles, and invest in the asset directly from the application.

Insurance app

The insurance industry is on the verge of transformation and more people are keenly focusing on upgrading or getting new insurance. Insurance is among the top trending FinTech categories that can help insurance companies grow and scale their business faster. As customers get to use the insurance services faster, the companies grow at scale using their dedicated applications.

Consumer finance

The last category but the most trending one is the consumer finance applications. With digital financing and money, lending is becoming popular, these apps are also getting more traction. If you are planning to launch your consumer finance application, it’s the right time to get started. There are several consumer finance applications that offer approved loans and the individuals can repay the amount in easy steps.

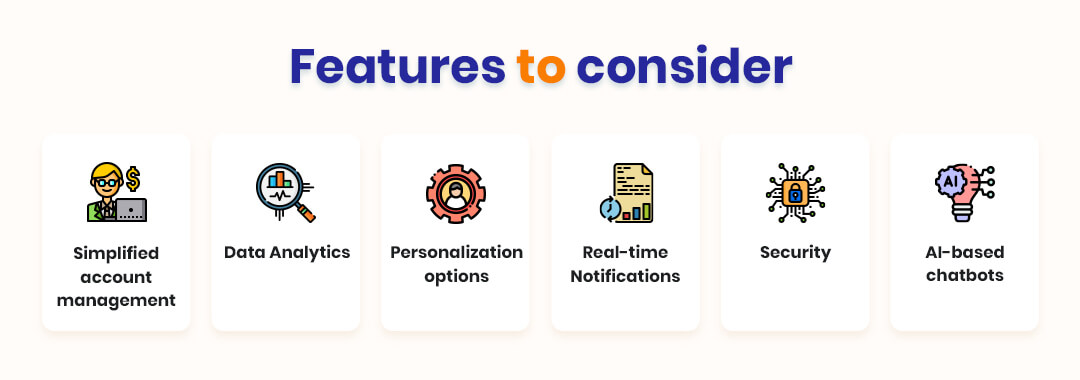

Features to Consider When Developing FinTech App

What kind of features and how many of them you want on your application will decide the final price of the project. A similar type of application can be built in both $10,000 to $50,000 but there is a significant difference in the number of features. So, before you start estimating a budget, consider these features that will help you get a more accurate estimate.

1. Simplified account management

Account management is a necessary and time-saving feature that every FinTech application should have. It helps the users to manage their multiple bank accounts and perform all the activities seamlessly. Be it transfers, verification, and daily tally for the users, account management is a must-have module in your application. When you have your finance or banking application, you easily check out your daily transactions, account records, and account insights & balances on the go.

In addition to this, you can also access the money transactions in a simple and secure way. The developer will add many features of account management like the Transfer of money using the phone number or email address. The more account management features you will add, the price will go up.

2. Data Analytics

When it comes to FinTech applications, data and analytics become pivotal driving forces. As a Fintech app development company, you can’t leave the money on the table and not analyze the data of your customers to improve your app and drive more quality features. Data analytics is an essential element of a fintech app as it enables users to locate and trace the records of their financial transactions. In addition to this, the app analyzes the entire data set and produces reports for the end-user. Data Analytics is a valuable tool that enables consumers to observe and trace their former financial transactions.

It not only helps companies to make the services better but also helps customers to be more aware of their financial transactions. Regardless of the size and type, you need to have the data analytics module in your application.

3. Personalization options

As there are various similar types of applications available in the market that offer almost similar features, standing apart from the crowd is important. You need to have some sort of custom features that are not available or don’t work well on other applications.

Adding bespoke features depends on the business type of requirements of your client. It begins with clients searching and communicating with FinTech app development companies with multiple business challenges. To resolve those difficulties, technology solutions are offered by the companies and developers will convert those solutions into features. If the custom solution is complex and requires more time to get fully ready, you need to spend more money on that special feature.

4. Real-time Notifications

We live in a hyper-connected world where we need to know what’s happening around us in the domains that we hold our interest in. When you develop a Fintech application, you should be providing updates and daily notifications to them. Be it a new product launch, policy update, or any other important update you want to deliver, is possible by using a real-time notification feature for your application.

Along with this, you should also be able to send reminders and notices to customers based on various categories that you have. With the notification feature in the application, you will make your and customers’ lives easier.

5. Security

Security is the most important concern of today’s world and you should not overlook this feature at any cost. For businesses that are looking to get an exponential jump from the competitors, only better security can help them do this. With customers getting smarter with available information, it has become inevitable for companies to operate transparently to grow their business. As there are several hacking attacks, data theft, forgery, and other risks involved in the finance world, having robust security is a must.

If your company’s application got hacked, there are most likely chances that the entire phone has been hacked and the customer has lost all the data. So, it’s important to pay special attention to security that will ensure the safety of your users and your company’s business-sensitive data.

6. AI-based chatbots

Chatbots are helping businesses do more stuff in less time by handling basic queries of the customers. Using an artificial intelligence-based text or voice-based chatbot will help you delegate several repetitive questions and queries that you get daily. Financial institutions and bank chatbots have the capability to enhance customer service. The fate of banking is conversational banking and the more quickly you answer your customers, the more positive response you will get.

Customers seek speed, convenience, and accuracy in the FinTech applications, and having a chatbot will help you get a kickstart in the competition.

These were some core features that you should have in your FinTech application to make it successful and accessible to the majority of the customers. Now, comes the most important question — How much does it cost to develop a FinTech application?

FinTech App Development Cost by App Types

To make the calculation simple, we have taken a standard development charge of $50/hour which is common across multiple nations. Let’s dive into it right away:

Banking-based Fintech app development cost

The majority of the banking application development companies will take around 3528 hours to develop an application for two platforms which are Android and iOS. So, if we calculate it with the average rate of $50, it would be around $176,400 per two platforms.

Stock-related or lending apps development cost

The lending and basic stock-related full-fledged mobile applications are less complex than the banking applications. The developers will take approximately 2254 hours to develop applications for both platforms and it will cost you around $112,700 per two platforms.

Investment app development cost

Investment bank’s application’s development charges vary a lot as there are so many features that companies can pick. However, companies usually take 2095 hours to develop a professional investment app and you should have an approximate budget of $104,750 for both Android and iOS combined.

Insurance app development cost

The estimated time duration for insurance applications is around 1386 hours for both platforms. When it comes to the overall estimated budget, it will cost you around $69,300 to have full-fledged apps for iOS and Android.

Consumer finance app development cost

Consumer finances can fall in both budget and expensive categories depending upon the type of features you need in the application. On average, developers will take around 3476 hours to build the app on both platforms that will cost you around $173,800.

Final thoughts

These are the average prices and estimates that you need to pay to get your application ready. But one thing you need to keep in mind is that these are just estimates and the actual cost of development will vary on what exactly you need. Want to know more about fintech application development costs, contact Auxano Global Services to get started.

![Complete Guide to Create Decentralized Apps (Dapps) [2023]](https://auxanoglobalservices.co.uk/new/wp-content/uploads/2023/03/Front-506x289.jpg)